Notice of Comprehensive Medical Insurance for Foreigners in China (Huai’an; 600yuan Standard)

Part One Insurance Items

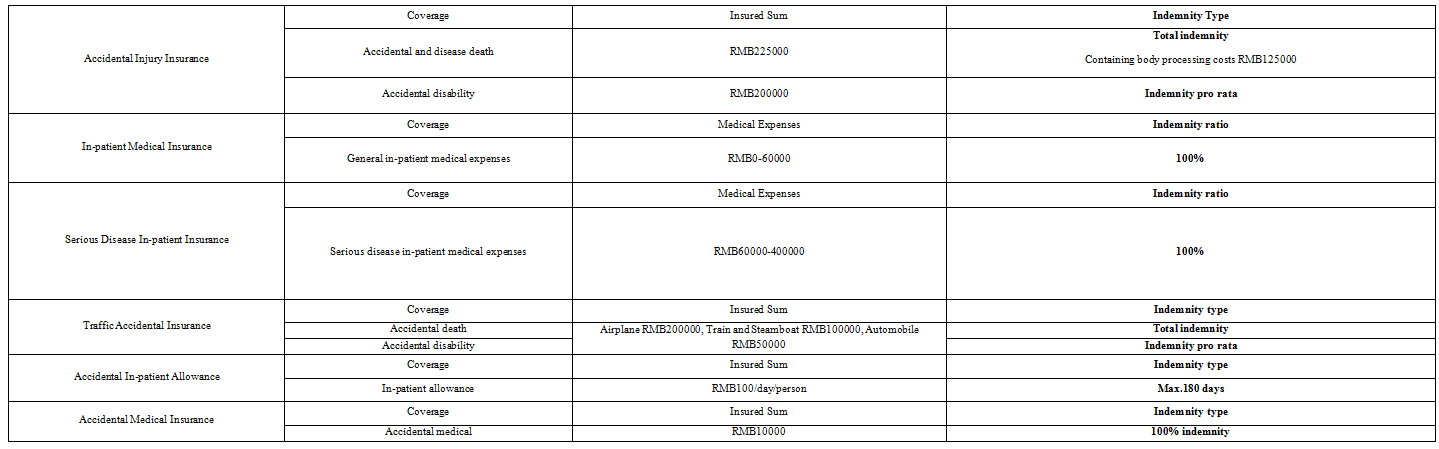

Insurance Contents Table

The service manual shall not be referred as insurance certificate, the insured policy shall prevail. We shall issue the policy and invoice.Remarks: The accumulative accidental insurance sum for the minor whose age is under 18 years old can not exceed RMB100000.

Service Guide

For guaranteeing the economic benefits for the foreigner who came to china when suffering from disease, you join in the insurance plan of life insurance and accidental medical insurance covered by Jiangsu Branch of Ping An Annuity Insurance Co. The insurance contents and service guide shall be shown as follows:

Ⅰ. Insurance Duration

Please refer to the time listed in the policy issued by our company after your application.

Ⅱ.Qualification

The insured is the visitor from abroad aging from 18 to 60 who is healthy and capable of normal work and normal living (charged by the rate of 100% for the insured who is aging from 18 to 60 years old, by the rate of 150% upon the basic premiums for those who are aging from 61 to 70, and by the rate of 200% upon the basic premiums for those who are aging from 71 to 75 years old.).

Ⅲ.Application Procedures

The institutions shall handle with application procedures .

Ⅳ.Beneficiary

The beneficiary of medical benefits shall be the applicant, and the beneficiary of death benefits shall be the legal heir to the applicant.

Ⅴ.Service Hotline

Service commissioner of Ping An Annuity Insurance Company, LTD, Jiangsu Branch (Biyun Wang)

Service tel: 025—84677217;13382070456

Ⅵ.Designated Hospital

1. The designated hospitals are those public hospitals over the district or county levels designated by the local medical insurance department. If an accidental and emergency treatment is needed, the non-designated public hospital can be chosen.

2. The branch of designated hospitals, foreigner hospitalization ward, special treatment ward, special treatment room and high-level cadres ward or those of the same kind are not in the regulated scope.

Ⅶ.Medicine

For the complete guarantee, the medical scope of the insurance plan shall refer to the regulation of Medicine List of Basic Medical Insurance in Nanjing.

Ⅷ.The scope of accidental out-patient and emergency treatment shall include:

1. Shock, coma caused by accident;

2. Emergency bleeding caused by accident;

3. Brain trauma, fracture, dislocation, avulsion, burn or other acute trauma;

Ⅸ.Claims

1.Claims procedures: when the applicant lodges a claim foe medical treatment, he/she shall fill in Insurance Claims Application with the seal and then give the relative materials to the service commissioner of insurance company.

2.Claims effectiveness: After taking the claims application, insurance company should finish claims within 15 working days and transfer the indemnity into the individual account of the insurer, or the insured can draw the benefits from the counter directly.

3.Forms Required in Claims

the out-patient or in-patient insurance application

The insured fills in the benefits claims application as the applicant and applies to the insurer for insurance with the following materials:

(1) Insurance policy or the other insurance documents;

(2) ID certificate of beneficiary;

(3) Duplicated documentation of the case history, diagnosis certificate, brief summary of leaving hospital, prescription and the original certificate of medical expenses issued by the hospital;

(4) Any other certificates and documents can be provided to prove the nature and cause of the insurance accident;

Remarks: the medicine invoice bought in drug store or in the other hospital shall not be included.

Ⅹ.Validity of claims

1.The insured should apply for in-patient or out-patient and emergency medical benefits within 3 months. Any legal consequences otherwise are borne by the insured.

Ⅺ.Notes in Claims

1.The information about case condition, inspection, treatment, medicine and dosage should be identified in the case history; the charged project in the receipt should be the same as the record in the case history; the date receiving treatment in the case history should be the same as that in the receipt.

Part Two explanation

I..Insurance Liability

1.Accidental Death Insurance

In case the insured suffers from accidental injury and dies within 180 days from the day when the accident happens, the insurer shall pay “accidental death insurance benefits” upon the insurance amount and the insurance liability shall be terminated.

2.Accidental Disability Insurance

In case the insured suffers from an accident and the disability caused is listed in Level I to X in Disability Level Compensation Rate attached to Ping An Additional Disability Security Group Accidental Injury Insurance (Edition 2013)(Clause D), the company will conduct evaluation towards the disability according to the rules and indemnify the accidental disability benefit by means of multiplying accidental injury insurance sum with the payment rate prescribed in Disability Rate Sheet in Affix I of this Agreement. For those insured still under medical treatment, the disability level certified 180 days after the accident will be served as the criteria for the payment of “accidental disability benefit”.

In case the insured is eligible for the insurance benefit for more serious disability due to the current accident and the last disability, the insurance benefit for more serious disability will apply but shall be deducted by the last paid compensation of disability insurance benefit (for those suffering disability listed in the Disability Level Compensation Rate or suffering above disability arising out of the responsibility-exemption events, it shall be deemed as the disability insurance benefit already paid).

The accumulative indemnity of accidental death benefits and accidental disability benefits of each insured can not exceed the insurance sum; the insurance liability shall be terminated when the accumulative payment reaches the insured sum of accidental insurance.

3.Disease-caused Death Insurance

In case the insured dies from disease, the insurer shall terminate the insurance liability upon indemnity of death benefits according to the insurance amount.

4.Accidental In-patient Allowance

In case the insured suffers from accident and must receive in-patient treatment by the advice of hospital within 180 days from the day when the accident happens, insurer shall pay in-patient allowance benefits with RMB100 for each day according to the reasonable in-patient days with the limitation of 180 days, and the insurer shall terminate insurance liability when payment days reach 180.

5.Accidental Medical Insurance

During the insurance term, in case the insured suffers from an accident and receives medical treatment within 180 days after the accident, the insurer shall indemnify the reasonable medical expenses by 100% upon the reasonable medical expenses.

This benefit will be paid without reference to times of the accidents, but the accumulative total per capita shall not exceed the insurance sum. The insurance liability shall be terminated when the accumulative payment reaches the insured sum.

6.In-patient Medical Insurance

During the valid term of the contract, when the insured who has not joined in the social insurance suffers from an accident or disease and must receive in-patient treatment upon the advice of hospital, the insurer shall pay in-patient medical benefits by the rate of 100% upon the reasonable accommodation fee (0-400,000 Yuan), reasonable operation fee and reasonable medical expenses which happened during the in-patient term (fees all at the person’s own expenses excluded; including Class B drugs and personal pre-paid fees pro rata in the treatment partially covered by basic medical care insurance).

Without reference to times of in-patient treatment, insurer shall pay supplementary in-patient medical benefits upon the mentioned appointment and the insurance liability shall be terminated when the accumulative payment reaches the insured sum.

In case the insured must continue to receive in-patient treatment when the insurance term ends, the insurer shall undertake the insurance liability for 90 days, but the insurance liability shall be terminated when the accumulative payment reaches the insured sum.

7.Traffic Accidental Death Insurance

In case the insured suffers from an accident and dies within 180 days after the accident when the insured rides a public traffic vehicle as a passenger, the insurer shall terminate the responsibility to the insured upon indemnity of the accidental death benefit.

8.Traffic Accidental Disability Insurance

In case the insured suffers from accidental disability when rides a public traffic vehicle as a passenger and disability is caused within 180 days from the day the accident happens which is listed in Disability Level Compensation Rate attached to Ping An Additional Disability Security Group Accidental Injury Insurance (Edition 2013)(Clause D), the company will conduct evaluation towards the disability according to the rules and indemnify the accidental disability benefit by means of multiplying public vehicle accidental disability insurance sum with the payment rate prescribed in Disability Rate Sheet in Affix I of this Agreement. If the insured is still under treatment, insurer shall pay the benefits upon the disability level appraised at the 180th day from the day when accident happens.

For disability caused in the accident this time as the insured rides the public traffic vehicle as a passenger coupled with the previous disability, if the insured is entitled to accidental disability benefit for relatively serious cases, the insured is indemnified according to the standard of the relatively serious case and the accidental disability benefit previously paid will be deducted(for those suffering disability listed in the “Disability Level Compensation Rate” or suffering above disability arising out of the responsibility-exemption events, it shall be deemed as the disability insurance benefit already paid).

The accumulative indemnity of accidental death benefits and accidental disability benefits of each insured in riding a public traffic vehicle can not exceed the insurance sum; the insurance liability shall be terminated when the accumulative payment reaches the insured sum of accidental insurance.

Ⅱ.Exclusions

1.The exclusions for accidental insurance, accidental medical insurance, accidental in-patient allowance insurance, disease death insurance, traffic accidental insurance, dread disease insurance shall apply with the exclusions in Ping An Additional Disability Security Group Accidental Injury Insurance (Edition 2013) (Clause D), Ping An One-year Term Life Insurance, Ping An Traffic Group Accidental Death/Disability Insurance (Edition 2013), Ping An Accessory Accidental Medical Insurance, Ping An Accessory Accidental In-patient Allowance Group Medical Insurance, Ping An Accessory Out-patient Group Medical Insurance, Ping An Supplementary In-patient Group Medical Insurance and Ping An Group Dread Disease Insurance Clause

2.With respect to the medical expenses caused under the following cases, the insurer shall not undertake the insurance liability:

(1) The insured suffers from intentional homicide or injury committed by the insurer.

(2) The insured commits intentional self-injury or a crime or resists the criminal coercive measures legally adopted or commits suicide (the insured committing suicide without capacity of civil conduct excluded).

(3) The insured is involved in fights, alcohol addiction, intentional taking-in or injection of drugs.

(4) The insured is found drunk driving, driving without a valid license or driving those unlicensed motor vehicles.

(5) Wars, military conflicts, riots or armed revolts take place.

(6) Nuclear explosion, radiation or pollution happen.

(7) The insured suffers from injuries due to pregnancy (including ectopic pregnancy), abortion or delivery (including Cesarean delivery).

(8) The insured suffers from injuries due to medical accident, drug allergy or mental or behavioral disorder (according to WHO International Statistical Categorization of Diseases and Relevant Healthy Problems (ICD-10)).

(9) The insured privately takes in drugs without following the doctor’s advice (those taking in OTC drugs in line with instructions for use excluded).

(10) Occasions like sudden death, bacteria or virus infection are run into (those suffering from wound infection caused by accidental injury excluded).

(11) The insured is engaged in such high-risk activities like diving, parachuting, rock-climbing, bungee-jumping, glider or paraglider driving, adventure exploration, wrestling, martial arts competition, stunt performance, horse-racing and car-racing.

(12) The insured suffers from HIV virus inflection or diseases in AIDS period.

(13) Other diseases unlisted in the Bill of Insurance written with specially stipulated diseases;

(14) Hereditary diseases, congenital deformity, Deformation or chromosomal abnormalities, mental disease or schizophrenia or other congenital defects or diseases;

(15) Anamnesis;

(16) The insured receives medical treatment at a rehabilitation center, polyclinic, privately-owned hospital, private clinic, family ward, massage hospital or experiences out-patient hospitalization.

(17) Medical fees caused in the dental care of the insured, such as toothwash, dental implant, artificial tooth, dental prosthetics, tooth defect restoration and porcelain teeth and fees caused in oral rehabilitation, orthodontics, oral care and aesthetic dentistry; (If the insured suffers from decayed teeth, endodontics or cracked teeth and needs dental filling, dental neural treatment, dental extraction, resistance dentition treatment or the insured suffers from periodontal diseases like periodontitis, gingivitis and periodontalginivitis (except the teeth cleaning treatment), all the medical fees caused within reasonable medical care scope are categorized in the insurance liability of the insurer.)

(18) Treatment in skin pigmentation, facial acnes, facial masks, scar beauty, laser beauty, nevus depigmentation, tattoo removal, wrinkle removal, freckle removal, eye-lid surgery, gray hair cure, bold cure, hair implant, hair removal, nose jobs, boob jobs, ear piercing and etc.;

(19) Orthopedic treatment: surgeries for bromhidrosis, dysphemia and snoring (except obstructive sleep apnea syndrome) and flatfoot treatment;

(20) Treatment in weight reduction, fat adding, height raising and etc.; treatment in various health checks like physical check-ups and disease screening; various preventive, healthcare, recuperative, convalescent or special care treatments including vaccination, foot reflexology massage therapy and fitness massage;

(21) Eyesight test and glasses selection; fitting artificial eyes and limbs or audiphones;

(22) Amblyopia, squint, refractive errors or other congenital eye defects;

(23) Diverse types of infertility and sexual dysfunction;

(24) Medical fees resulting from the insured and prescribed by the local social basic medical insurance department in charge as self-borne fees ( Provisions otherwise prevail.);

(25) Treatment fees and drug fees resulting from the insured and prescribed by the local social basic medical insurance department in charge as partially self-borne fees( Provisions otherwise prevail.);

(26) Infertility treatment, artificial impregnation, pregnancy, childbirth(including dystocia), miscarriage, abortion, birth control (including sterilization), prenatal and postnatal check and complications caused (Provisions on female childbirth obligations otherwise prevail.);

(27) Matters related with medical accidents caused by plastic surgery or other kinds of surgeries;

(28) Medical identification of various types: labor capability identification (labor, working injury and occupational disease diagnosis identification of employees), forensics of psychiatric patients, medical accident identification, various injury check fees and etc.;

(29) The insured receives treatment at hospitals that are designated or acknowledged by the non-insured.

(30) The insured transfers to another hospital for treatment without approval from the insurer

(31) Medical fees happening to the insured on insurance expiration day and meanwhile exceeding the validity of insurance agreement; medical fees occurring overseas and Taiwan, Hong Kong and Macau; (Provisions otherwise prevail)

(32) Checks, treatment, drug use are inconsistent with the diagnosed diseases.

(33) Fees occurring in emergency treatment under emergency circumstances unprescribed by this Agreement;

(34) Substitutive dispensing and outside dispensing;

(35) Direct dispensing or drug taking for those without history cases of main state or disease diagnosis;

(36) Mental and behavioral disorders (Be determined according to World Health Organization " International Statistical Classification of Disease and Related Health Problems (ICD-10)");

3. All insurance liabilities are exempted on the accidents caused by previous diseases before insuring (anamnesis) and complications or previous disability.

Medical expenses occurring in treatment and rehabilitation towards malignant tumor, heart disease (cardiac insufficiency above level II), myocardial infarction, leukemia, high blood pressure (above level II), cirrhosis, chronic obstructive bronchial diseases, cerebrovascular diseases, chronic renal diseases, diabetes, aplastic anemia, epilepsy, infectious diseases prescribed in Infectious Disease Prevention and Treatment Method of People’s Republic of China and other uncured diseases and their complications or previous disability before the insured has him/her self insured this time;

Among those, anamnesis refers to diseases or symptoms the insured suffered from and that the insured already have known or should have known before the valid date of the Agreement. Normal cases are:

(1) The doctor already has a clear diagnosis before the insuring behavior and the long-term treatment is continuous.

(2) The doctor already has a clear diagnosis before the insuring behavior and the symptoms still linger after treatment which still need intermittent drug taking or treatment.

(3) Symptoms are evident and remain before the insuring behavior without any diagnosis or treatment from the doctor, bur in normal cases the diseases are known according to general common sense in medicine.

Appendix I: Disability Benefit Percentage Table

Notice for Medical Insurance Claim Procedure for Self-sponsored Int’l Students

Hospital: public hospitals of district and country level or above (ordinary beds)

Medication scope: medication within the scope of Nanjing(Or local) medical insurance (or referring to local medical insurance)

Name used during treatment: Suggested use Passport Name or part of Passport Name

Emergency Out-patient Treatment |

Documentation |

Provider |

1. Emergency Certificate (with University Stamp) |

1. University |

2. Invoice (Original) |

2. Student(Patient) |

3. Out-patient Medical Record (Copy) |

3. Student(Patient) |

4. Insurance Policy (Copy) |

4. University |

5. Passport (Copy) |

5. Student(Patient) |

6. BOC Bank Card copy (both sides) |

6. Student(Patient) |

7. BOC Bank Deposit or withdraw receipt obtained at the bank counter |

7. Student(Patient) |

8. Alteration Application Letter |

8. University&Student(Patient) |

9. Bank Transfer Account Confirmation Certificate (with Student’s signature) |

9.University&Student(Patient) |

10. Compensation Application Letter (signature on the left bottom side) |

10.University&Student(Patient) |

11. The Same Person Certificate |

11. University |

Designated Hospital: